Are lower interest rates worth waiting for?

A little finance lesson: High interest rates are a huge problem for our customers. It has made them scared to invest; it has caused many to postpone buying decisions as they all hope interest rates are going to come down under the new US Government Administration. As much as I'd like to hope that is true, we can't plan on it for the simple reason that long-term interest rates for borrowing money for home mortgages and capital equipment are set by the bond market.

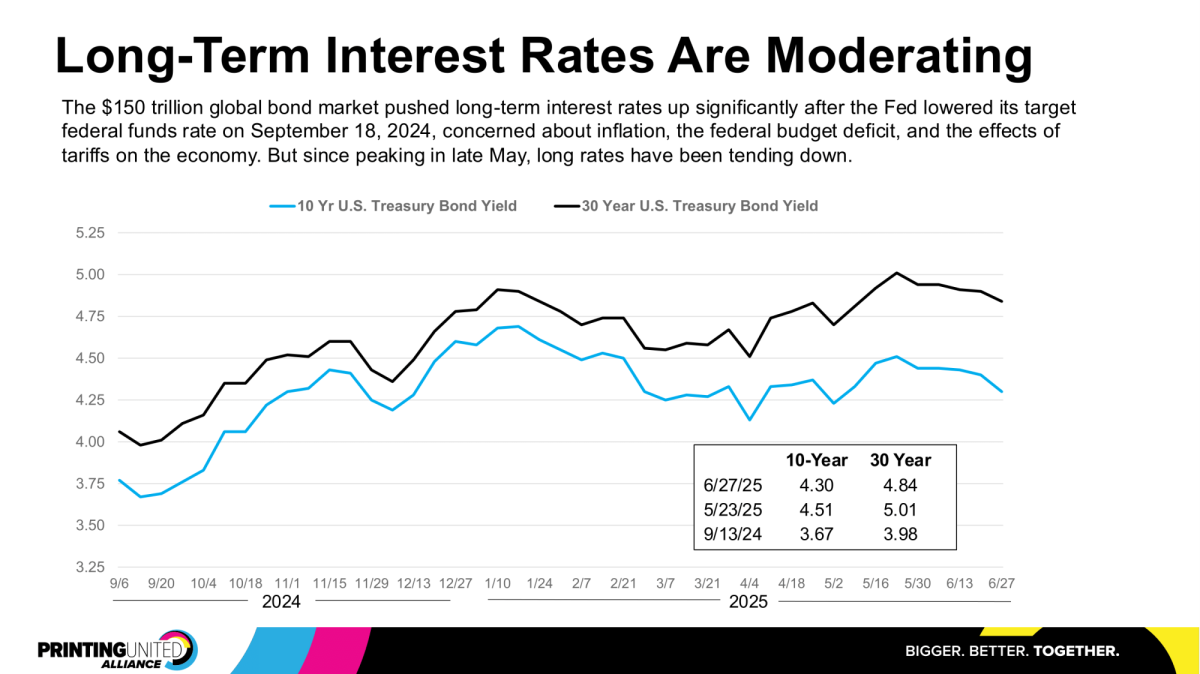

The bond market anticipates these rate changes, and prices them into their long-term interest rates. To set the long-term borrowing rates, the bond market looks at the general economy, which is incredibly resilient. It looks at unemployment statistics, which remain low. Those two factors alone tell them that there is no need to lower long-term interest rates any time soon. In the summer of 2024, the bond market expected a rate cut from the Federal Reserve based upon comments made by the Federal Reserve in July. The first rate cut in years indeed occurred in September 2024 but note that immediately after the September rate cut long-term interest rates started rising again. This is because the US economy remains in good shape, reducing the likelihood of further big short-term interest rate cuts.

While high interest rates represent a challenge for printers, Kodak is helping mitigate the impact by providing solutions which offer unmatched productivity that amortizes the costs over more jobs and pages. Don't wait for interest rates to come down, because they probably won't any time soon. If you can make the return-on-investment justification today on buying new equipment, there is no better time to buy than now. Investing today will only make the return-on-investment look even better as corporate taxes come down, so there is no upside to delaying capital investment.

Read the previous blog in this series:

Inflation is threatening to make print a luxury good